Initial Comments

I discovered VHI back in 2024, I was impressed by its very rapid share price rise and wrote it off at $8 as I thought i was late to the party, but as i say it is better to be late than sorry, I took time and dove into the case and saw multiple parallels/characteristics I love and that we will discuss in this deep dive, I built a position around $11 and it was very recently that I added significantly to my position near $9.3 per share (all documented on my X account)

The market sometimes gives second chances!

As far as I know this is the biggest and most in-depth dive into this healthcare SaaS provider, and I feel blessed to be able to reach a point that I am interviewing management teams for the retail shareholder community!

Created with TradingView

Grab a coffee and get ready to discover another small cap gem, making its mark in the Vertical Software Universe which as many of you know is one of favorite areas to fish for winners.

Let’s begin

Basic Stats

Market cap - 695 Million

Price per share - $10

EV/FCF - 30

Rev Cagr 3yr - 37%

EPS 3yr - 83%

Gross Margin - 80%

FCF margin - 20%

Introduction

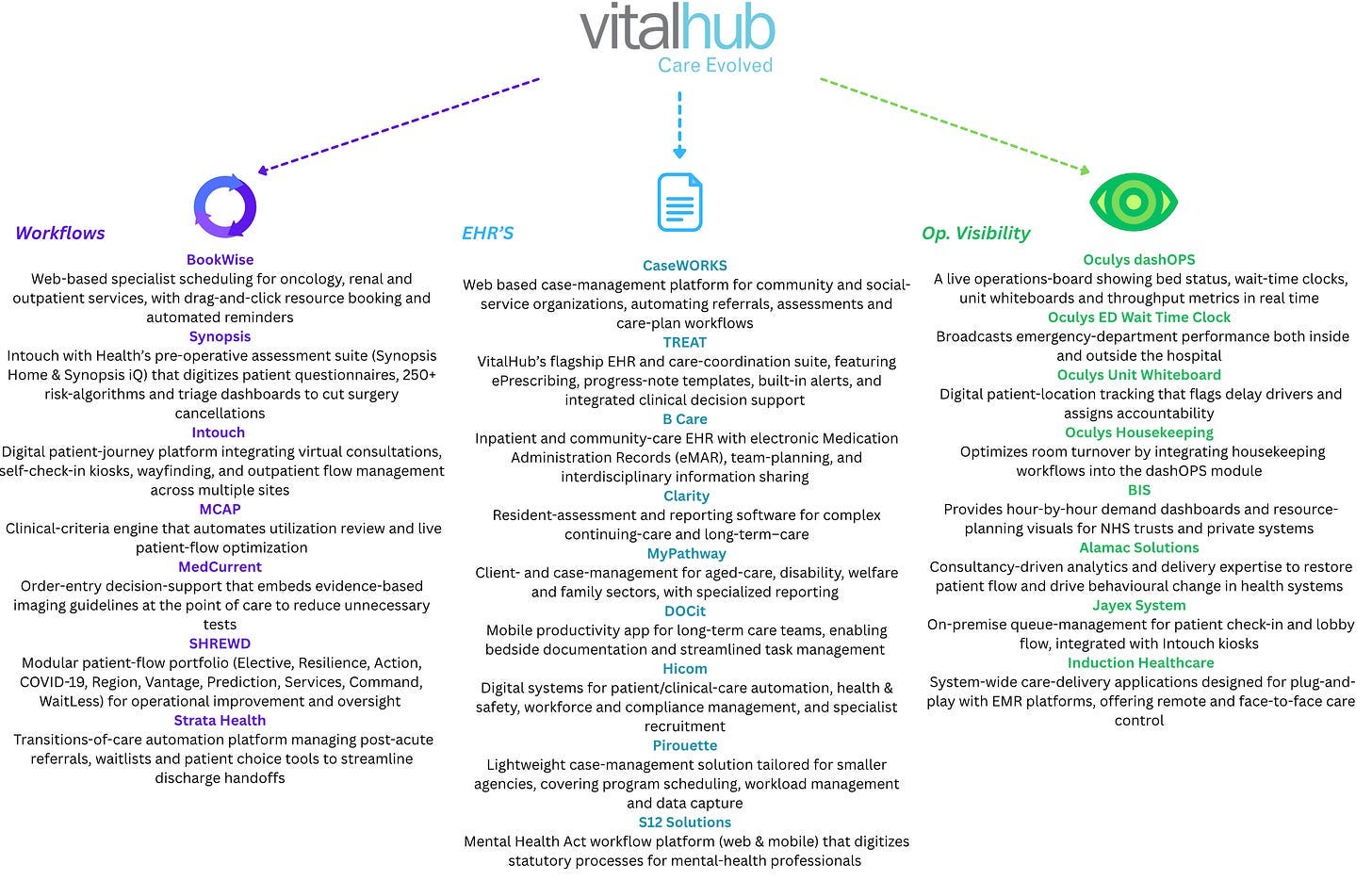

The company was founded in 2010, and at first glance it is just an IT healthcare business but it is much more than that for investors willing to look under the hood. It provides a variety of SaaS solutions to thousands of clients globally, VitalHub’s product portfolio is broad, including electronic health records (EHR) systems, patient-flow and operational visibility tools, and workforce/care automation platforms to help healthcare institutions cater better to their clients needs.

The result - Serving thousands of institutional clients across Canada, the UK, and Europe, they have explicitly stated that they don’t plan on expanding in the USA for reasons I will cover later.

They have a very diversified portfolio of digital solutions with over 60+ products. After carefully examining their pipeline I can say they go for a more holistic approach, so I have observed that because their products are so well integrated in the system of hospitals and clinics that are far more likely to purchase multiple software solutions (upsale) and most importantly stay with the company for a long time (Low churn rates).

Business Model & Offerings

Products & Solutions

EHRs - Having some experience in the healthcare business, the toughest issue is not actually treating patients but optimizing the logistics behind the treatment. A big solution to this issue are EHR’s, which integrate data from multiple sources: clinical notes, laboratory and imaging results, medication histories, billing and enable secure sharing across different care settings via network‑connected systems. Their goal is to help digitalise patient data , improve the workflows and operating efficiency of hospitals. This of course greatly assists the treatment of the client as all data about his treatment, history and medication are organized in one place. Hospitals that use EHRs are able to decrease patient stay at the hospital and free space for new patients, reducing the average hospital stay, and increasing customer satisfaction, more on that in a bit!

What I have found intriguing about EHR’s is that they mass adopted in the Canadian (93% of hospitals) & UK (90%) markets in which Vital-hub operates, Europe plans to massively start using/adopting them and in my view this a very large aspect of their growth case, but I will cover this deeply on the Future catalysts chapter.

What EHR’s do and are so essential —> Clinical documentation (example is patient history) , Computerized Physician Order Entry (CPOE), ePrescribing & pharmacy integration, Scheduling & patient registration, revenue cycle management tool’s, Patient portals & population health analytics and more. Hospitals/clinics and care facilities are getting into digitalisation, they are also getting required to do so as a means to reduce heavy bureaucracy.

VHI solutions are CaseWorks (Case Management platform for Community & Social Service organizations) & TREAT (EHR, Case Management & Care Coordination with ePrescribing). So what differentiates them is they don’t only present data as most providers do but give insights into what care providers need to help them advance delivery of care BUT the software is also adaptive and customizable towards the needs of the clinics and it is a big aspect of the competitive advantage the company possesses.

Caseworks Module

They also offer Billing dashboards, offered by TREAT. These reports include workload, referrals, wait lists but also key performance indicators (often custom made) of the clinics/hospitals . Worth mentioning that this data is offered real time and it is fully responsive, it can be used on all devices (Pc, tablets even phones).

Their drag and drop approach dashboard creation helps all non tech savvy users (most of the time they aren’t very tech knowledgeable) to create custom graphs, charts and even heat maps, I consider this approach to scream moat potential.

The data aspect of the business is severely ignored in my opinion but more on that later.

Giving a clear example of the value they are able to provide, a medium sized mental health clinic was able to compress their month-end billing cycle from 10 days to 2. This was actually possible by auto claim triggers for recurring residential care and the web focus report builder (one of their tools), thus the clinics are able to to reconcile claims daily ,via generation of AR aging dashboards, much faster

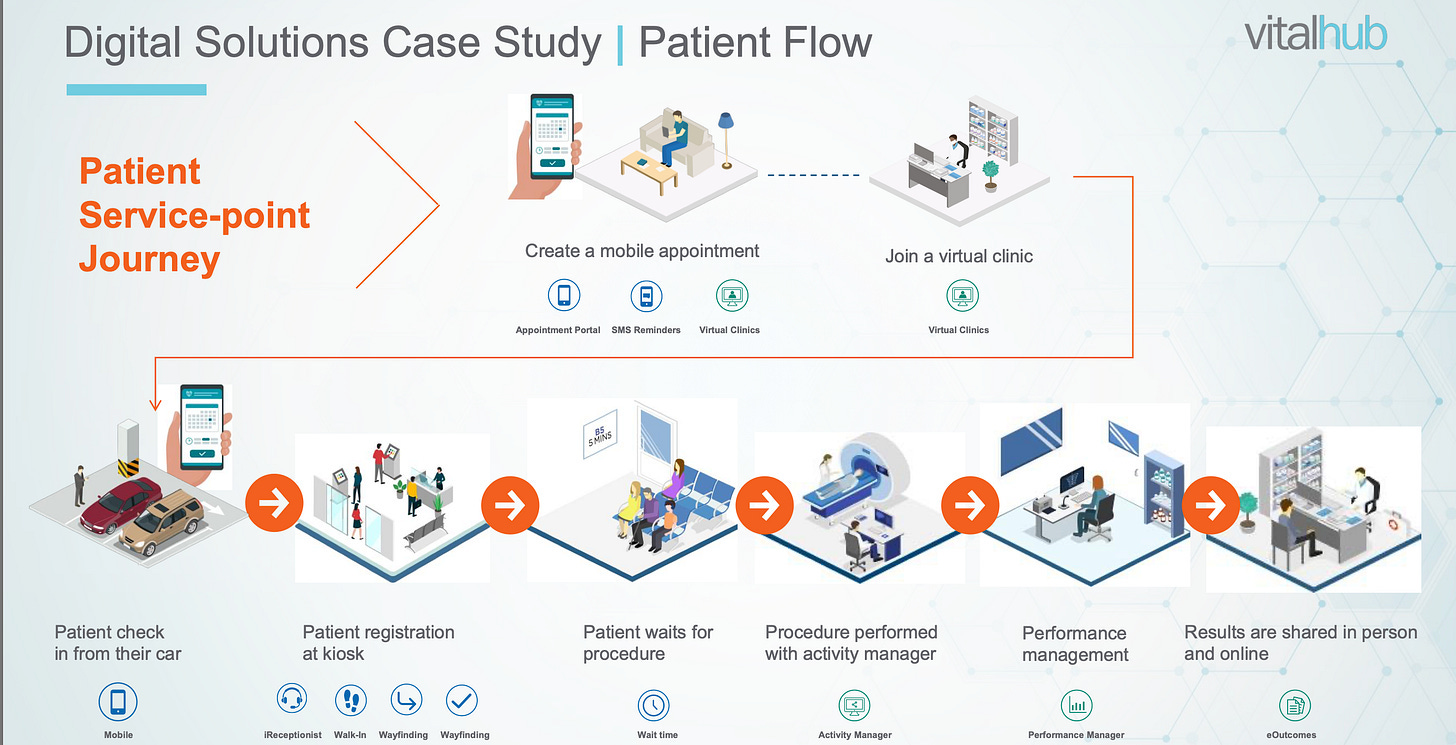

Patient Flow - This is the second key business segment (and the most important in my view), patient flow refers to the procedure of the treatment/procedure of the client from start till finish. From the time the appointment is scheduled, to the arrival, registration, diagnosis, treatment, discharge and options follow up care. This process from start to finish has so many flaws (no shows, manual errors, it is not optimized to reduce time efficiency and costs). VHI comes here with multiple solutions. Bookwise (Acquired, UK) offers a centralized structure for the scheduling via preoperative slots, kiosks and mobile check in’s, this allows patients to confirm arrival, fill consent forms, fill data this approach reduces no shows, reduces congestion in the receptions and has many more benefits that will be discussed in the value proposition segment.

Intouch - Manages entire patient journeys and optimises outpatient flow across all appointment types, face-to-face hospital appointments, virtual (video or telephone) appointments or remote appointments in the community. The platform integrates with the hospital’s PAS / EPR, supporting a joined-up approach to patient-centred care and optimised work-streams, as previously isolated processes become connected in a seamless manner. As a result of this integration, the entire patient journey can be mapped and recorded digitally from arrival to discharge, with all information visible and accessible across the hospital to relevant staff live the time it is happening.

Intouch - Work station

Intouch - Room & Resource manager

But it does not stop here it also improves operational efficiency, for clinic rooms and resources with real time visibility and dedicated communication channels for team coordination. When the appointment is finished outcomes & data is captured with the purpose to trigger the next steps, follow up appointment or aftercare.

Utilising freestanding kiosks or their mobile phone, patients can self-check in at the hospital, reducing the need for reception staff to manually check patients in for their appointment, saving time and boosting customer satisfaction.

Synopsis (In house software) provides digital pre-op questionnaires and risk stratification, ensuring clinics can book only those patients cleared for surgery and flag high-risk cases for extra care.

Synopsis module for flagging/patient data.

Just like they do with the business analytics segment they have real time flow management including bed status (occupancy rates), ED wait time clocks (very important) and resource availability. This allows for better team coordination, resource management and transportation of patients without delay.

Most tools of competitors end here, and to extend I understand why, already they helped with management and planning, but VHI does not stop here,

MCAP & MedCurrent (both acquisitions), Macp is more focused on clinical inefficiencies and in live patient-flow workflows to improve bed utilization and reduce unnecessary inpatient days, while MedCurrent assists with choosing optimal treatment paths to avoid errors (enhance decision making of physicians). These solutions are mostly for the treatment/main part of the patient journey, for discharge they offer tools to communicate with patients about possible aftercare or services.

The data aspect of workflows is there as well with multiple KPI’s generated regarding client data that will assist in enhancing operations (Length of stay, time spent on each step of the progress, capacity utilization, satisfaction and many more).

Dual function again like EHR’s, Operations & Data collection + Management

Operational visibility tools - I have already mentioned some of the tools above and they are mostly complementary/an important piece to workflows. They are solutions incorporated in all stages of the workflows and they help track data real time while allowing for insights & control in order to rescue delays, improve coordination and ofc care quality. If workflows are the brain, operational visibility tools are the eyes.

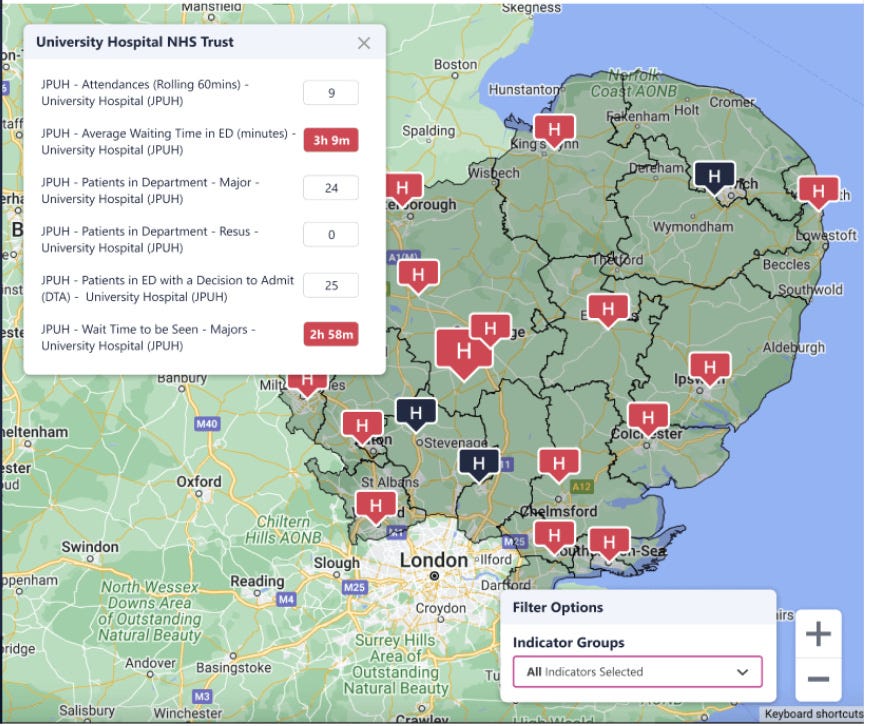

The main tools are Oculys and SHREWD that basically collect all the information from EHR systems as well as bed management etc and combine everything under dashboards (always keeping them simple and compact).

In these dash boards important data can be found including - Average wait time, discharge blockages, patient status and bed availability. What I really like here is that they take a step further and extend the usage of the dash board to be able to pinpoint delays (e.x missing orders or a pending client transportation) allowing for proper responsibility assignement to the responsible team.

These are mostly the capabilities of Oculys, SHREWD on the other hand is a modular (cloud native) platform that takes the capabilities of Oculys and extends them regionally across multiple hospitals/clinics. It uses all of the key indicators we have already discussed (ED, average wait time, ambulance handover times, community discharges) and presents them under a unified operational view (the data as it is sensitive in nature is transported in real time via secure feeds). Both operate on all devices!

It has visualisation capabilities as it displays a live BRAG-rated heatmap, showing high- (red), medium- (amber), and low-pressure (green) zones across geographies, with click-through drill-downs into site-specific metrics, I love how it allows for customization. This is extremely helpful as it helps identify areas needing urgent support. As seen below!

Extra solutions: Vantage - Ambulance and patient-transport metrics, enabling dynamic redirection to reduce handover delays, Elective - Planned-care backlogs and capacities across multiple sites and sectors (including private), helping manage surgical backlogs and plan rescheduled procedures, Action - Automated escalation alerts tied to surge thresholds notifications route directly to teams, with digital action plans and real-time progress tracking via mobile/web & WaitLess: A public-facing app showing live queue stats, wait times, and travel durations for urgent-care facilities allowing patients to pick the site based on data (helps really with decongestion in hospitals).

The numbers do not lie, their software is used in 68% of the NHS in England & over 1100+ NHS providers. NHS is the National Health Service in England and is one of the largest and most important clients of Vitalhub!

So I made this beautiful graph so we all understand their approach of being one shop for everything under a single umbrella.

Source - VHI, Graphic design from me

Value proposition of the business

Okay so far we have seen what the solutions are, how they are used, by whom and why they are used, but it is of utmost importance we examine what are the benefits/value the solutions bring to the table. I went and read as much content available on how workflows & EHR’s can benefit hospitals and clinics, I focused on giving real examples with numbers, data & scientific studies.

A Study done on Al Hada Armed forces Hospital with over 420 beds and 3k staff showed reduction in average hospital length of stay (from 11.5 to 4.4 days) and average emergency department boarding time (from 11.9 to 1.2 hours) and the improvement of bed turnover rate (from 0.57 to 0.93) (Harbi et al, 2024). The reduction in average emergency department boarding time also significantly reduced mortality rates, time management is extremely important in this industry.

AI-driven scheduling and capacity alerts can cut average wait times by up to 20% and reduce unnecessary inpatient days by 10–15%, there is much potential that can be unlocked via the implementation of Machine Learnings and Ai in it’s system, there is big demand to be met here, but more on that later!

Synopsis has been used within the NHS to complete over 120,000 patient pre-operative assessments, contributing to an average saving of £1.4m per Trust. Savings are generated from the reduction of last-minute cancellations of surgery by an average of 20% and further administration time reductions, releasing nursing time back to the departments and increasing patient satisfaction across the surgical pathway. Another segment of Synopsis allows in-home assessments over 65% patient uptake and eliminates more than 1,025 kg of CO₂ emissions every four months by reducing travel for hospital appointments. In total it serves more than 10.500.000 million clients.

Besides clinics & Customers it significantly improves the brutal working conditions of PSW (Personal Support Workers) not only the insights help them know where they need to be and when but also saved them 23 minutes per every 8 hour swift (according to VHI data), also Registered Practical Nurses (RPNs) saved about 1.5 hours per shift.

Intouch digital check-in kiosks have an average patient self-check-in rate of 80%, which reduces queues at reception, releasing staff time and saving patients an average 4.5 minutes during check-in. This process receives, on average, over 85% positive feedback from patients. This very platform is responsible for

On average, payment for outpatient procedures equates to 18% of an NHS Trust’s overall income. However, it is estimated that up to 10% of this is lost as a direct result of incomplete or misplaced paper outcome forms, with Intouch every outcome is captured and used efficiently.

The company if you put it under the microscope it is logistics software for clinics, as the key focus is resource management & time management solutions. It ties into workforce management modules that align clinician rosters with patients automating shift assignments and reducing costly overtime. The solutions aren’t a nice addition to the infrastructure of hospitals/clinic’s but mission critical software.

Time management + Synergies + Cost cutting + Resource management + Operational improvement = A very solid Value proposition

I initially wanted to talk with a client of VHI directly but the management told me this is not feasible as they prefer to protect client data due to the sensitive nature of the business. I respected their wishes and chose to go with medical studies, testimonials and available data.

Moat & Acquisition business model

As with every business I look for an edge, operational leverage or executional excellence that helps the business differentiate and ascend its competitors. Does VHI have an edge?

Software has been for quite sometime the cornerstone of my portfolio, and it is very simple why, in this nature mission critical software becomes very sticky and a key piece of the operations. It is sticky because it becomes embedded not only with the day to day operations but because it acts as a large database with the clients, in this instance patient data.

The best type of investments do not need to be overly complex, imagine someone tomorrow offering a better price to the customers of VHI, removing the software to replace it would seem in my opinion catastrophic especially when it is so vital for so many aspects of the clinics. After that you have to factor in training the staff to become accustomed to the new type of software solutions, it would take a while to adapt. Costing more time and money!

And all of my hypothesis is actually backed by real data, in their latest Investor Presentation I can see 2 figures that stand out to me.

Customer churn of 3-6% - This is best to calculate the percentage of individual customers lost in that x period, and you see it is very low given the 5-7% industry standard benchmark. Very good job here!

They also presented a 100% NRR ( net revenue retention) which means that they were able not only to fully offset all revenue lost to customer downgrades and cancellations but also generated enough expansion (upsells and cross-sells) from its existing base to keep net recurring revenue flat or growing. Loyalty and stickiness are very evident from my research.

Data - I consider one of their abilities is that most of their modules are active collectors of data, effectively creating a closed data loop were every entry/input from clients at every stage of their treatment feeds analytics via the solutions presented thus far to improve decision making but this also allows the data to be processed and offer even better insights after (it is very familiar with how every mile driven by Tesla cars makes the data machine better) , the more data processed the better their solutions become, and in my view this aspect of the business model is not properly discussed by any analyst.

Almost every module is a continuous data sensor ( kiosks, iReceptionist, EHR entries, operational dashboards) VitalHub builds an adaptive learning ecosystem. Real-time insights fuel protocol tweaks and resource changes, which generate new data to refine the next cycle. This system gives VitalHub customers faster issue resolution, higher utilization rates and continuous service evolution, very very difficult to match or replicate by any competitor.

Another aspect of their edge in my opinion is regulation/ compliance. Software providers in these types of industries, have to meet very high security standards mainly ISO as well as NHS Data Security & Protection, as they work and process very sensitive data. VHI has a compliance framework for multiple countries in order to meet regulatory demands, deepening the moat and making it very difficult for competitors to grab market share as well as

Acquisitions

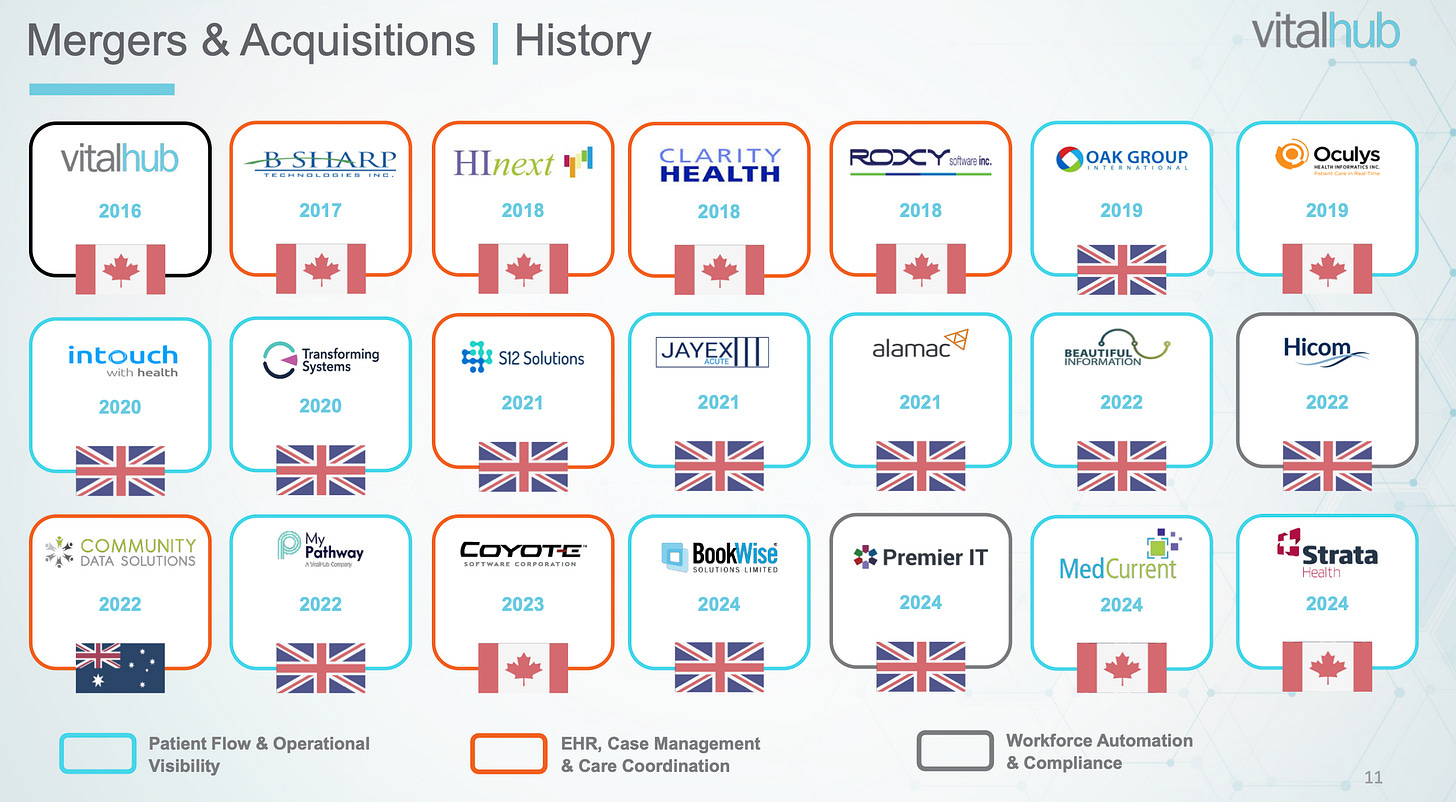

One of the most important aspects of the growth story is how VHI is able to locate and acquire companies to fuel operational synergies and growth.

Their criteria are simple

1-2.5x revenue (Not always followed strictly)

2-20mil annual revenue

Of which revenue 60%+ recurring (Very closely followed)

Not losing money (break even or profitable)

5-7 year cash payback

20% or better adjusted EBITDA

Synergies with existing products

To further understand the acquisition strategy we must talk about their Lab,

Innovations Lab in Sri Lanka - This segment started 15yrs ago as a small team of four people supporting one product, is now at 200 people strong (around 500 people work for VHI in total to understand the size and importance of this lab) , supporting multiple solutions. The lab is fully-owned and operated offshore and most importantly allows the company to save substantial costs on software coding/R&D and customer support cost (the CFO described it as a 30c on the dollar saving). This allows the company to generate large cost synergies in their acquisitions. (Sources VHI, VIC)

Did I mention synergies?

Synergies - A huge part of the thesis as well as the business model are synergies (a very common phenomenon in niche serial acquirers like VHI). VitalHub’s strategic roll-up approach key platform integrations illustrate these synergies in action: BookWise scheduling (acquired Feb 2024 for 3.1 M pounds not $) brought 150 + UK/Australian customers into VitalHub’s EHR ecosystem, boosting module attach rates and accelerating deal velocity the Premier IT Partnership deal, allowing synergies with Hicom’s workforce-automation tools, improving the clinician roster and compliance workflows across the UK customer base. Compliance and regulation is of utmost importance in sectors like Health care & Finance.

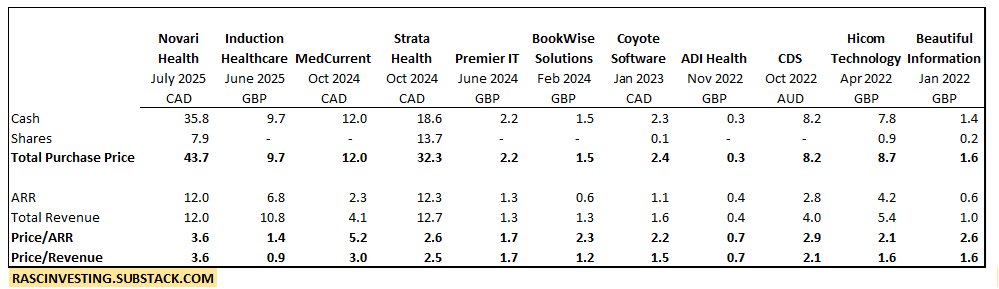

Source - VHI investor presentation, all acquisitions besides the most recent Novaris!

We can examine synergies as well in MedCurrent’s, OrderWise decision-support (acquired Oct 2024 for $12 M) is now embedded in TREAT EHR at 80 + sites, deepening clinical-decision integration. Strata Health’s $32.3 CAD, Transitions of Care platform was folded into CaseWORKS, extending automated referral workflows into post-acute and community settings across multiple Canadian health authorities. These are some of the examples of how acquisitions stick to already existing parts of the operations and make them more efficient/functional. All different but connected like a river flowing.

I think the below picture perfectly illustrates how these synergies/connections work together.

More data on all acquisitions to data by my friend

←(Amazing analyst, deserves a follow!)Acquisitions 2017 -2021

Acquisitions 2022 -2025

There are 3 possible paths a company can take to make acquisitions and drive growth, it is either using free cash flow/cash, debt or share dilution.

In this instance Vital-hub prefers to go with share dilution, this inherently is seen as bad practice, given a very bad reputation by multiple value investors. To an extent I understand this viewpoint simply because it dilutes your stake in the company, EPS, and it creates share price volatility. It is the weaker part of the thesis.

I was also skeptical of this practice (still am to an extent), but I can't deny how useful it is for the business model. It helps bring fresh cash to be used for acquisitions as their organic growth is stellar (We will discuss more in the next chapter). Cross selling and ARR retention and client expansion as some of the main ways value is unlocked via acquisitions, going into specifics the Med-current and Strata helped expand on so many different clients 1000+ and helped ARR significantly!

I would like to present an example that it is not always about revenue and ARR, the latest addition to the VHI teams was Novari health a deal that costed , 35.8mil cash issued 733.726 shares to Novari shareholders total 7.8mil, but the real maximum total is 48.6mil max as there is a separate 5mil earn-out bonus, in my view is a means to leverage further the NHS relationship as Novari is exposed to the main markets Vitalhub operates in the UK/Canada, and it has also been deployed to Island Health in British Columbia creating even more channels for product distribution. It was a more expensive than usual acquisition but I understand the reasoning behind it.

The real question is, is dilution doing more harm than good?

So far no, as long as they don’t overpay for acquisitions and find strong synergies, I find this model to be sustainable for now, but I would like for more cash/debt to be used given how pristine their balance sheet is. They operate with 0 debt and a hefty cash position.

I will quote CSU here

The higher the quality of the company the more you are willing to invest in organic growth. In a good management team you are willing to invest in acquired growth.

Economics

I want to focus here examining their economics, in margin profile, ARR, organic growth and growth from acquisitions.

Growth - For the last 3 years they have been growing revenue on average for 37% CAGR, trading in the mid 30’s for the last 2 years, I consider a 28-30% Rev CAGR for the next 3 years as very plausible.

Balance sheet - As pristine as it gets, 0 debt, and 91 million cash position (as per q1 2025), the only forms of liabilities they have is deferred revenue. Worth mentioning that they have 65mil available in debt capacity.

Examining the margin profile profile as the 4 most important figures in my view are the following, Gross, EBITDA, Operating margin and FCF margin. Keeping the Gross high given the acquisitions is very important and a beautiful sight, goes to show the effect of acquiring companies with such high ARR.

The EBITDA improvements from 12% up to 23% shows me that the synergies indeed work and have room to further improve.

FCF margin peak in 2023 should be ignored as it was greatly exaggerated by a big change in working capital, 20% is realistic and more accurate in my opinion.

Their margin profile is durable, improving and has room to become even better.

Now let us examine Revenues a bit closer

What I left for last in my comments for why I love software, is that the revenue most of the time besides being essential for operations is also recurring. I absolutely love when this trend is evolving at such a stable rate. Predictability and stability are key but quarterly revenue growth as well. The organic ARR growth has trended between 4.5-6% per q on average, The bolt on acquisitions have played a significant role in this result!

I can assure you that this mixture of organic & inorganic growth is impressive, most serial acquirers are lucky to be able to have 20% of their revenue in organic growth contribution, here it is over 46%, in this timespan of 7q’s the incremental organic revenue has CAGR of 2.6% per Q while in the same span the acquired basis has contracted in terms of % basis but grew in size from 7.2million to 11.9million (63% total) while organic has grown from 5,72mil to 10mil (74% total).

I do believe the Innovation lab has played a huge role in this mixture by offshoring R&D and software engineering (the team is very talented there), they can cut software development costs by up to 20% (maybe even more) versus Canadian standards. The Sri Lanka lab constantly rolls out updates to existing modules and has recently integrated Ai driven analytics. The biggest key solutions that drive organic revenue are made in this very lab.

Acquire/Create - Integrate - Constantly Improve

TAM & Growth divers

The thesis here is simple, the two markets they operate are EHR’s & Clinical Workflows

EHR’S - Currently this market is worth around 33.4 billion will grow at an annual 4.5% CAGR reaching 43.5 Billion at 2030, solid growth but not impressive

Clinical Workflow - Currently worth 11.4 Billion is expected to grow at an annual 20-23% CAGR reaching 40.2 billion, and this is where they are betting big, in the last 5 years they have completed 15 acquisitions 10 of them being directly on workflows!

I do believe a big aspect of the thesis is the ongoing demand for data & analytics in Healthcare, the operational visibility tools remain a very underrated side of the business as I explained above.

A crucial aspect of the growth thesis are mandates. Being very familiar with European markets there is a big trend of EHR & Workflow mandates (HITECH and HIPPA).

NHS specifically introduced in October 2023, mandating “Core 5 UK Standards” for digital health products. Covering APIs for patient identity, appointment scheduling, clinical summaries, document exchange, and messaging. These standards ensure systems must send and receive standardized FHIR compliant data. These same mandates apply to secondary and community clinics, that means besides the public sector which is NHS the private sector is forced as well to follow with compliance here.

Even small clinics are obligated to comply and connect their systems to national infrastructure (Due date by end of 2025), All VHI products cover the full spectrum of the needs for the CORE 5, TREAT Book wise, shrewd and oculus are must have tools NHS and deeply embedded within their systems (data remember?) which is why they are willing to overpay for acquisitions like Novaris.

Canada is essential to the bull thesis as well, there is current multi year roadmap to incorporate analytics, ehr’s and structure in clinics and hospitals that stretches to 2027 (Pan‑Canadian Health Data Strategy), what is interesting is that even though EHR penetration is extremely high (95 % of physicians now use EHRs) clinicians still face fragmentation due to inconsistent workflows and lack of integration (Source PMC, Miller et al 2025). Issue here being ‘’lack of integration with current systems or having multiple systems that are not connected. Physicians report spending an average of 86 minutes a day beyond what would be reasonably expected, looking for necessary patient data.’’

I think the holistic nature of VHI solutions and the interconnectivity of their solutions could be a wonderful solution to these problems. Their workflows don't streamline only operations but data as well.

There are many other initiatives that can benefit vitalhub, Halo, Ontario Patience before paperwork program and many more that especially target workflows.

Tailwinds

SaaS in healthcare is seeing a lot of demand, expecting to grow 20% CAGR to 2030

Besides EHR & Workflows they offer analytics & data via operational visibility tools, there is an ongoing and increasing demand for those especially now with Ai advancements.

Aging population of Europe & in North America

Europe has a strong tendency of staying behind, soon i believe digital health records & will be required in most countries here. I expect more national programs to roll out, their already experience in these systems & regulation makes them have a strong edge over competitors.

There is a lot of potential with smaller clinics & hospitals

Before finishing this deep dive I spoke with the Ex. Director of a large diagnostics company (Revenue over 100m), that wants to apply AI & Workflows into their systems, there are many smaller and medium sized companies in Europe that wish to make this transition and this is a trend I speculate to remain favorable. The demand from my research is there.

Ai

I am aware that mentioning AI causes cringe on most investors but hear me out, they already use it within their software and I think there are multiple applications to come. Three main examples

Synopsis - Already uses Ai via 250+ tailored algorithms to support the clinical decision-making process ahead of surgery. Synopsis iQ was also one of the first dedicated pre-operative assessment solutions to fully integrate with the hospital’s PAS / EPR. (VHI source)

Medcurrent - Uses AI criteria in imaging orders (tons of potential) at the point of care, improving diagnostic efficiency and reducing unnecessary tests.

Semantic search - The engineering team deployed AI-powered semantic search across its platform. This feature leverages large language models (OpenAI, Ollama) and vector databases (Qdrant), enabling natural-language querying of help articles and clinical guidelines (Source VHI, Linkedin)

I think they will benefit from these applications and will find more ways to extract more of their solutions even more.

Management & QNA

VitalHub was co-founded by Giancarlo De Lio and Prateek Dwivedi. Dan Matlow is also a key figure, having founded Medworxx, which was acquired by VitalHub, and is currently the CEO of VitalHub. Francis Shen is the Chairman of the Board. Management currently has 15% insider ownership, and around 70%ish institutional.

Dan Matlow (CEO) and Brian Goffenberg (CFO) have been the leaders of Vitalhub’s M&A/organic growth strategy since 2016 and have executed very well thus far. Both executives have a long, successful history in the healthcare IT space, having previously collaborated at Medworxx and successfully organically growing the business over a number of years before exiting to private equity. If you look at their previous conference calls over the past few years, they’ve generally provided conservative guidance and achieved it.

I also want to point out how eager the management is to put out content for the company whether interviews or podcasts to this very article, they were quick to respond and help with every question, something not observed in other companies in this market cap size. I would like to deeply thank Mr. Sgro ,whom I communicated with, for his willingness to answer questions from my community in X. I deeply appreciate it!

1. When will the company stop issuing shares and use its own cash flows for acquisitions as this hurts FCF per Share growth

VitalHub: With a strong balance sheet, positive cash flow, and access to debt, we would only issue shares to pursue acquisitions that we believe will be accretive to shareholders. We do not need to issue shares although we will do so if we see acquisition opportunities that can drive synergistic scale and an acceleration in long-term per share value.

2. The focus forward will be acquisitions on smaller or larger size, if so, why? & how many companies in M+ A crm, and what are your criteria in terms for metrics for your acquisitions

VitalHub: As we become larger, we increase our financial and operational capacity to acquire larger companies. Our sweet spot continues to be in the $2 to $20 million revenue range. We have 400 companies in our database, approximately 75 of which we maintain an ongoing dialogue with to assess strategic priorities. Key criteria include 60% recurring revenue or higher and a five to seven year cash payback based on our modelling.

3. With what criteria did you select Sri Lanka for the innovation lab, are the plan to continue growth there or move somewhere closer to target companies

VitalHub: The Sri Lankan Innovations Lab came with one of our first acquisitions. We have grown the team to around 200 employees, from around 25 at the time of acquisition. They are very talented and have a strong culture. We plan to continue growing this hub and have been expanding the functionality of the group to support more areas of the business.

4. What per share metric you think represents the most the value the company creates over time

VitalHub: We think that adjusted EBITDA and Cash Flow from Operations (on a total or per share basis) are the two most valuable metrics for us to focus on for creating value.

5. When evaluating acquisition targets, does Vitalhub specifically look for companies where clear synergies can be realised? If so, could you share a concrete example of a past acquisition where those synergies have been successfully achieved?

VitalHub: We look for companies that have the potential to achieve a Rule of 40 software profile, and consider revenue and cost synergies in our modelling. A common example is augmenting Quality Assurance or R&D work with our Innovations Lab, to add to our consolidated capabilities in a cost-effective manner.

6. Would Mr. Matlow & the team consider selling VHI

VitalHub: We receive inbound interest from Private Equity and other buyers, however we are not currently interested in selling. We see a large global opportunity for growth and consolidation, and think there is a long path of value creation as a public company.

Valuation & Risks

Before we move to valuation we need to examine the risks, which are in my view the following

Overpaying for acquisitions that destroy value vs Creating it

Unfavorable political environment related to funding, NHS is 17% of UK government spending, health budgets can vary based on multiple political factors outside of VHI’s control.

Revenue from the UK accounts roughly for 60% of revenue and almost all UK subsidiaries work with the NHS, a big part of their business is correlated there, so there is a concentration risk here. 50% of the acquired companies are UK based

Currency fluctuations (although they do a good job controlling this), they report in CAD while earning most revenue in GBP. Fluctuations in GBP/CAD exchange rates can hurt their profitability

Cybersecurity due to the sensitive data being processed & Regulatory Compliance

Due to the aggressive acquisition strategy, their ROI figures aren’t strong yet, although improving, would like to see more here.

During their Q1 earnings call the team pointed out that were cautious over the March 2025 UK government announcement that the NHS would be merged into the DHSC. This merger will take about 18 months to be completed and it worries me as it can affect subscription agreements and conversion of the pipeline the guidance remained unchanged so far but I will monitor carefully in Q2. So far no negative effect seen.

Investing at the end is all about the valuation you pay vs the value you get, even if you buy the best, most productive company in the world and you pay the wrong price you will end up losing money. I tend to avoid extensive and complex modeling as it is very susceptible to changes and inputs, In the past i have avoid stellar investments because i was way too stubborn on inputs and rates, the possibility of properly guessing numbers on your DCF 10 years from now are comical, I prefer going as far as 3 years out.

Given the management recognizes EBITDA & Operating cash flow as the main drivers of shareholder value, I will examine their valuation on that basis alone.

Before we assess valuation keep in mind

Annual Revenue Growth rate - 30%

85% Recurring Revenue

Hefty acquisition runaway

EV/EBITDA - 22.9x NTM

P/OCF - 32x NTM

P/FCF - 31x NTM

Passes the rule of 40 with flying colours!

Given the trajectory + positioning + future growth and accounting for the risks, I do believe current valuation is slightly extended (last time the stock reached $12 management diluted), in my view an entry $8-10 is ideal for more conservative investors. But as with every investment you ultimately bet on the management’s ability to execute, and they have earned my trust so far!

Till the next one…..

*This took tons of time and effort if you can subscribe & Like it would mean a lot :)

Disclaimer - I am long and own shares in VHI.TO and plan to continue holding them for a long time, this is not financial advice but just my opinion on this company

Great work! Tysm for sharing.

One q - you mentioned "they have explicitly stated that they don’t plan on expanding in the USA for reasons I will cover later" - I couldn't find which reasons. Do you mind elaborating?

Thanks!

I love how thorough this was!